One of the world’s largest fertilizer producers doesn’t expect any short-term relief in prices. Eduardo Monteiro, country manager for Mosaic in Brazil, said there are clear signs that phosphate and potash prices will remain at current levels — or even climb.

“There’s no expectation of downside in the short term,” Monteiro said in an interview with The AgriBiz. Mosaic is the global leader in combined phosphate and potash production, with most of its mining assets located in Canada.

For phosphate fertilizers, the main pressure point is sulfur supply, a key input in phosphate production. International sulfur prices have surged from about $150 to $500 a ton over the past four months, Monteiro said.

Beyond strong Asian demand from the mining industry, sulfur output has faced temporary interruptions in Russia due to the conflict with Ukraine, which has targeted some Russian refineries.

“Since sulfur is a major component in the cost structure of SSP or MAP — lower and higher-concentration phosphate fertilizers — we don’t see any reason to expect phosphate prices to fall,” he said.

For potash, pricing signals are coming from China, another heavy importer and a global benchmark for this market. Historically, China’s potash import prices run about $10 a ton below those paid by Brazil. But in a contract signed about two weeks ago, China paid the same price as Brazil.

“This is an important signal for consumers. If China used to buy at $10 less and has now closed a contract at the same price as Brazil, there’s theoretically no room for prices to drop — given the global dynamics in a market with few producers and huge consumers,” Monteiro said. “So I don’t see meaningful room for a decline in potash chloride prices.”

Farmers Demand

In Brazil, farmers’ demand may help keep prices firm, as purchases for the second-crop corn and for the upcoming soybean crop remain sluggish.

“So far, fertilizers’ sales for the next soybean crop reached only about 10% of what we expect to sell — and the volume sold is concentrated in Mato Grosso,” he said in a reference to Brazil’s largest producing state.

Although fertilizer-to-crop price ratios are slightly less attractive than last year, Monteiro still considers it’s a good moment for farmers to buy fertilizers for the summer crop.

For the second-crop corn, with deliveries starting this month, farmers are running about 10 percentage points behind last year’s buying pace — roughly 60% purchased versus 70% a year ago — even though price ratios are more favorable this season.

“What’s the consequence? We’ll likely see some stress in the market, something that happens recurrently but perhaps with greater intensity this year,” Monteiro said. The “stress” mentioned by the executive refers to possible logistics bottlenecks or localized price spikes driven by sudden bursts of demand.

2025 Deliveries

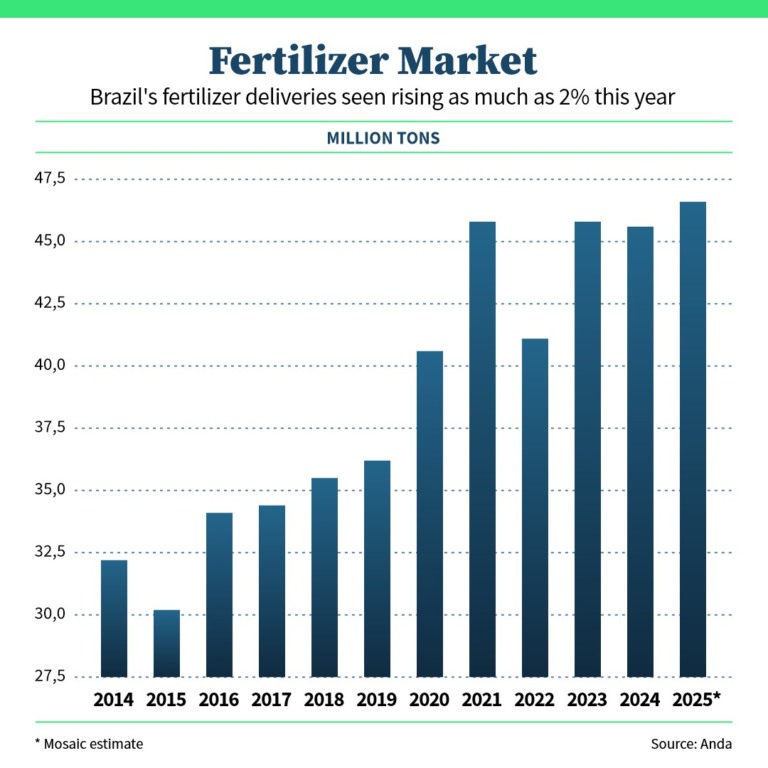

Fertilizer deliveries in Brazil are seen rising as much as 2% this year, an increase of 1 million to 2 million tons from 2024, said Monteiro, who is also the head of the local industry group ANDA. That’s below initial growth expectations of 4% as tight credit conditions have curbed farmers’ demand during the year.

“But there’s an important detail: the level of nutrients that will be applied to the soil this year is very similar to last year,” he said.

Brazil has seen a shift in its fertilization profile this year, with a sharp rise in imports of lower-concentration nutrient products. Examples include urea being replaced by ammonium sulfate and MAP being substituted by less-soluble phosphate sources.

“Lower solubility means lower productivity,” he said. “China is becoming Brazil’s largest fertilizer supplier, both for nitrogen and phosphate. For nitrogen products, solubility isn’t a concern — but it is for phosphate. And this product now accounts for 12% of all phosphate blends available in the market.”

“The practical effect of this move is that average soybean yields could fall by as much as 30% after three years of application,” he warned. Time will tell.