The poultry industry is experiencing an unusually prolonged boom, with robust — sometimes record-breaking — profit margins persisting far longer than many experienced market watchers had anticipated. For nearly two years, a surprising balance has prevailed between supply and demand. Not even hefty profits have triggered a production surge.

This scenario is atypical, especially for a highly competitive and agile market like poultry. With its shorter production cycle compared to other proteins, chicken output typically responds quickly to periods of strong demand. High margins usually lead to increased bird placements on farms, causing oversupply and price drops — flipping a bullish cycle into a bearish one within months.

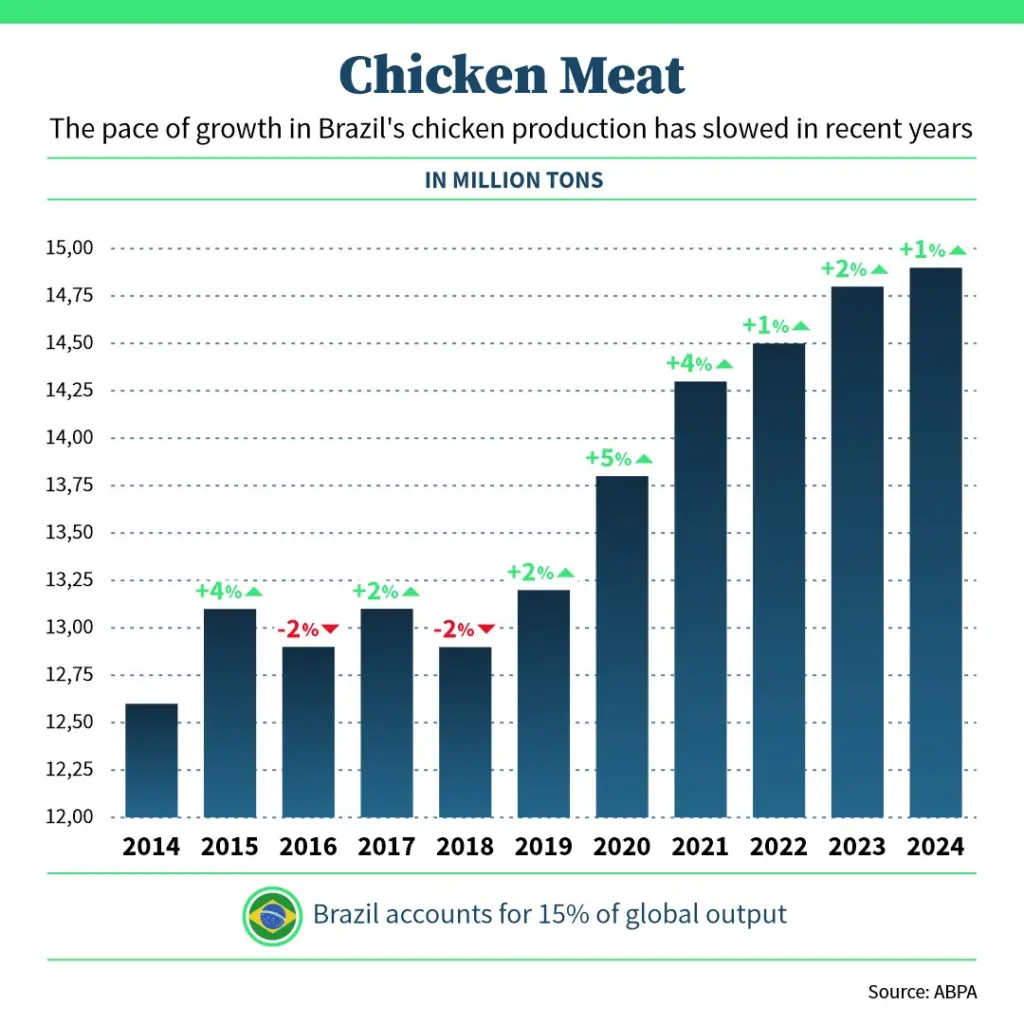

Amid rising demand, strong chicken prices, and manageable production costs, expectations pointed to output growth in Brazil and globally. Yet, the sector’s leading players continue to signal that the market will remain balanced. While greater discipline across the industry has played a role, there’s a deeper constraint at play: poultry genetics.

The issue began around two years ago with a shift in broiler breeder lines. In an effort to boost weight gain — a key industry demand — genetics companies prioritized feed conversion efficiency in their breeding programs at the expense of fertility, according to sources who spoke to The AgriBiz.

The outcome: fertile hens are laying fewer eggs, and hatch rates have declined — meaning fewer chicks per egg.

“The bird out in the field is a meat-producing machine. It can reach nearly 3 kilograms in 40 days — incredible weight gain. But when you select so strongly for these traits, others become less prioritized in the lineage that hits the market,” said a senior industry source.

A fertile hen typically lays about 200 eggs in her productive life. Birds from the new lineage are laying 10 to 18 fewer eggs, the source explained. Hatch rates have dropped from roughly 85% to between 75% and 76%.

“That’s huge. It’s as if we suddenly lost an entire Aurora [a major Brazilian poultry producer] worth of output just due to lower egg and chick numbers,” the source said.

JBS Global CEO Gilberto Tomazoni highlighted the challenges in poultry genetics during the company’s fourth-quarter 2024 earnings call, while commenting on the prolonged chicken cycle. “There is a fairly stable level of supply across proteins. In chicken, where it’s usually easier to ramp up production, there are challenges with the new genetics that have reduced egg fertility,” he said in March, without providing further details.

This genetic bottleneck — not unique to Brazil — is compounded by avian health emergencies like bird flu. In the U.S., the world’s second-largest poultry producer, avian influenza has wiped out over 120 million birds in recent years. The impact in Europe and Asia is harder to quantify but also constrains global chicken supply.

Bredeers Shortage

In an effort to offset fertility setbacks, producers have tried increasing the number of breeder hens — but face a physical limitation: there are no breeders available for purchase in Brazil this year. “You have to plan ahead and typically get only a partial response for the following year,” another industry source noted.

Producers are also changing management practices and extending breeder lifespans — strategies that may negatively impact productivity. Another potential fix lies in new crossbreeds.

“But 2025 is already locked in. Part of 2026 is too. So we’re looking at two more difficult years in terms of supply,” the source said.

Globally, the poultry genetics market is dominated by two companies: Cobb Vantress, owned by U.S. giant Tyson Foods, and Aviagen, controlled by Germany’s EW Group. Cobb did not respond to interview requests. Ivan Lauandos, president of Aviagen Latin America, confirmed there is a shortage in the poultry genetics market.

“We haven’t been able to meet all orders,” Lauandos told The AgriBiz. But he emphasized that it’s not due to a lack of investment. In July, Aviagen will open a new farm in Santo Antônio da Alegria, São Paulo state, with an annual capacity of 3.8 million breeder hens.

“That’s 6% of Brazil’s total capacity,” he said. Last year, Brazil placed 60.5 million breeder hens, according to ABPA (Brazilian Animal Protein Association).

The new farm is part of 738 million reais ($130 million) in investments Aviagen has made in Brazil over the past five years. These funds expanded its breeder capacity from 6 million birds in 2012 — when its market-leading ROSS 308 AP chicken was introduced in Brazil — to 25 million today. Grandparent stock, which produces the breeders, has also increased from 1.9 million to 2.9 million birds.

According to Lauandos, this expansion has boosted Aviagen’s market share in Brazil, expected to reach 65% in 2025. “We’re doing everything we can to meet the rising demand in Brazil,” he said.

In addition to boosting domestic capacity, Aviagen has begun supplying Latin American breeder importers from operations in other countries like Argentina and Colombia — previously, exports came solely from Brazil, the world’s largest chicken meat exporter. “This is a way to increase availability for Brazil,” Lauandos explained.

He did not attribute the current bottleneck to flaws in genetic selection, adding that breeding is a continuous process guided by industry demands. According to Lauandos, the average hatch rate for Aviagen genetics reached 81% in 2024 — considered within the normal range.

“There was a drop in breeder productivity during the pandemic, but that impact ended in 2024,” he said. The executive also pointed out wide productivity variation among Brazilian farmers due to differing levels of technology, management practices, and feed quality.