Five years ago, when Israel-based ICL Group pivoted toward specialty fertilizers seeking for higher margins, Brazil quickly gained relevance in the company’s long-term strategy — a move that is poised to accelerate.

After completing three acquisitions in Brazil over the past years, ICL is actively seeking for further M&A opportunities.

“We still have an appetite for acquisitions. We’re looking at everything that comes our way,” said Alfredo Kober, ICL’s top executive in the country.

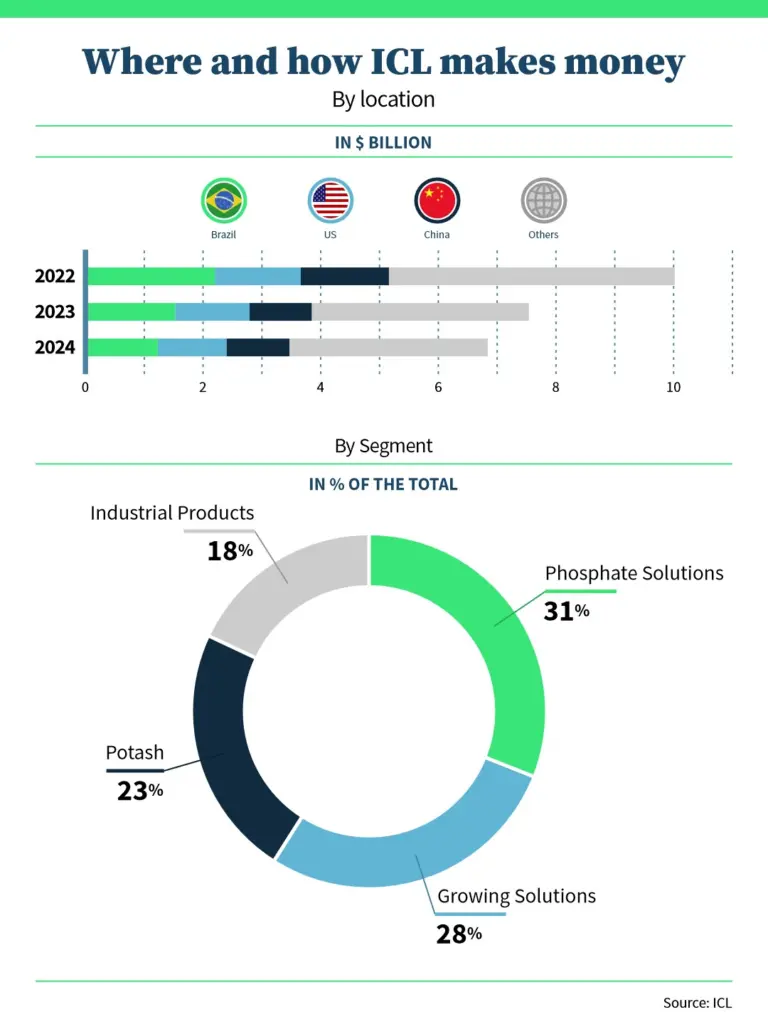

Brazil is ICL’s largest market worldwide, accounting for 18% of the company’s global sales in 2024, ahead of the U.S. and China. The company’s revenue in the nation totaled $1.2 billion last year even amid a downturn in the domestic ag-inputs sector.

Kober, an executive with over 30 years of experience in the ag-inputs industry, makes no secret of ICL’s ambitions in Brazil — nor of the challenges ahead.

“Many companies won’t have the technological renewal capacity to keep up. The market will consolidate, and we want to be one of the consolidators,” he said during a press briefing on Wednesday. “Our challenge is to maintain this leadership position.”

According to Kober, more than 800 companies are currently active in the specialty fertilizers segment in Brazil — a level of fragmentation that makes consolidation inevitable.

ICL is already one of the largest players in the country’s specialty fertilizers market, a position secured through acquisitions totaling over $270 million. In 2020, ICL paid $120 million to acquire FertilAqua, a plant nutrition firm then controlled by the private equity firm Aqua Capital.

The following year, it acquired ProduquImica through a $120 million deal involving Compass Minerals’ South American operations. In 2023, ICL bought Parana-based inoculant maker Nitro 1000 for $30 million.

Beyond M&As

While acquisitions remain a key pillar, ICL’s strategy in Latin America also hinges on expanding its product portfolio and increasing its market share — particularly by bringing more farmers into the specialty segment, which currently reaches only about half of Brazilian growers.

For the 2025/26 crop year, ICL is aiming to outpace the foliar fertilizer market, which has been growing at roughly 25% annually, according to Kober.

Listed on the Tel Aviv Stock Exchange, ICL has a market value of $9 billion. While its specialty business is gaining ground, the company — controlled by Israeli billionaire Idan Ofer — remains a major player in traditional nutrients, with assets including phosphate and potash mines and bromine extraction from the Dead Sea.

ICL holds a 5% share of the global potash market, trailing only giants Nutrien (20%), Mosaic (14%), Belaruskali (14%), Uralkali (14%), and Eurochem (5%).

In 2024, the potash division accounted for 24% of ICL’s sales and nearly 30% of operating profit. Its phosphate solutions business represented 32% of sales and 41% of profit. Meanwhile, the growing solutions division — home to ICL’s specialty fertilizers — contributed 29% of revenue but just 15% of operating income.