After a turbulent period in the agricultural inputs market, Mosaic Co. is entering a new expansion stage in Brazil. A key milestone will be the opening of a new fertilizer plant on July 16 in the city of Palmeirante, in the norhern state of Tocantins — a strategic location in one of Brazil’s new agricultural frontier.

The facility, backed by a $77 million investment, will add 500,000 metric tons to Mosaic’s deliveries in 2025, helping to boost the company’s volumes in Brazil by 15%. Mosaic expects total sales in the country to rise from 10 million to 10.8 million tons this year, supported by strong domestic demand. Roughly half the output from the new plant is already committed.

With a planned full capacity of 1 million tons per year, the Palmeirante facility offers more than just scale. Located along a railway network, the plant enjoys direct logistical access to the Port of Sao Luis — cutting transportation costs and reducing truck traffic by 20,000 trips annually, an outcome that supports Mosaic’s emissions targets.

“We have been developing a growth positioning strategy, which is now starting to materialize,” said Eduardo Monteiro, Mosaic’s country manager for Brazil, in an interview with The AgriBiz.

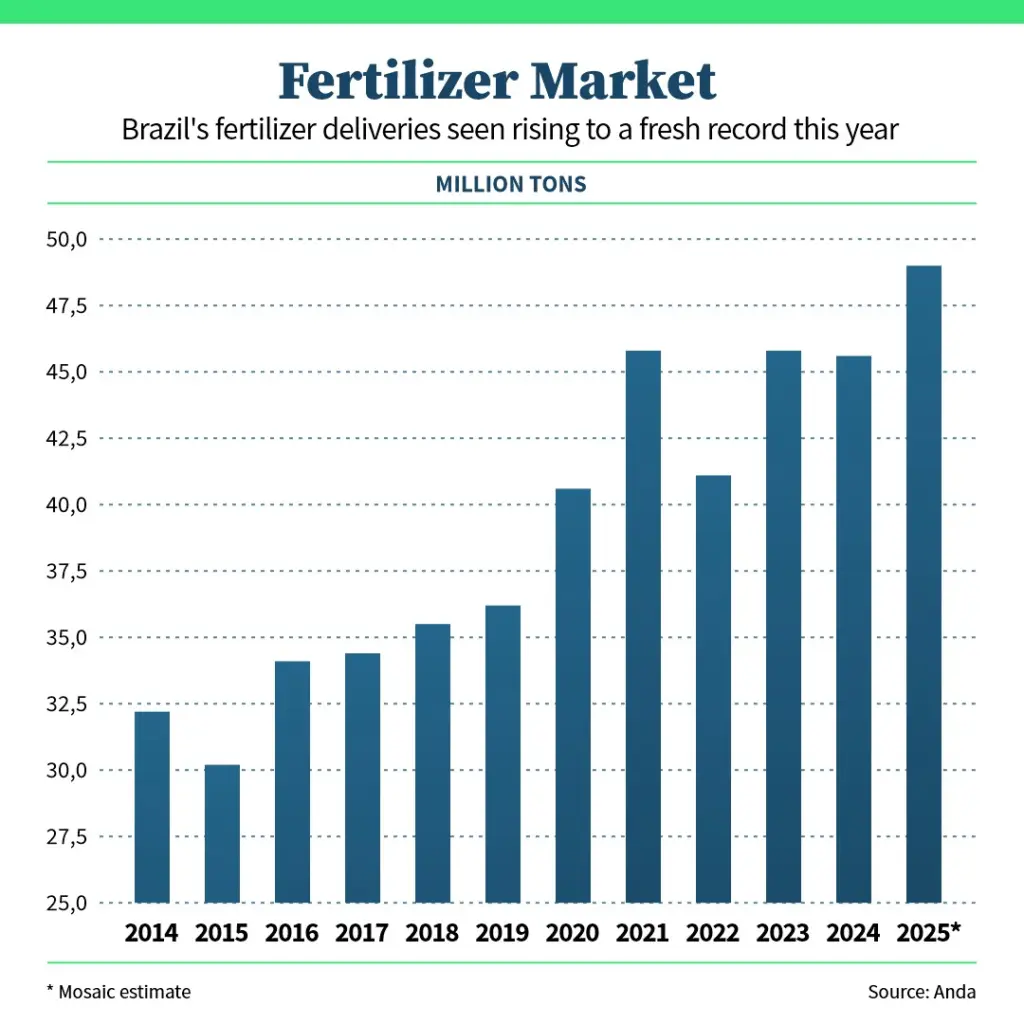

Brazil’s fertilizer market is entering a bullish cycle, with 2025 demand expected to hit a record 49 million tons, up from 46 million this year, according to Monteiro. Rising farm incomes will encourage growers to replenish soil nutrients after a bumper harvest, he said.

Tariff tensions are also contributing. The US-China dispute has opened windows of opportunity for Brazilian farmers, who capitalized on a favorable exchange rate and soybean premiums to secure input deals earlier this year.

Credit Concerns

The head of Mosaic’s Brazil operations said credit conditions remain a key concern in the South American country, with default risks increasing alongside Brazil’s benchmark interest rate, currently at 14.75% per year. According to him, farmers are borrowing at annual rates ranging from 18% to 20%.

“This is very challenging — it’s extremely costly for producers. The high interest rate is increasing perceived credit risk in the market and is reflected in the rising number of bankruptcy protection filings,” he said. “At Mosaic, we have a strong risk management framework and tools to monitor these developments, but it remains a key area of concern.”

In the agricultural inputs distribution market, Monteiro sees a shift underway. Cooperatives and trading companies are gaining ground as large retail chains lose market share — a result of store closures and mounting financial pressure.

Mosaic is also betting on bionutrition as a pillar of long-term growth in Brazil, a market the company sees as the global driver of biological inputs adoption. But regulatory hurdles remain.

Current rules prevent the use of microorganisms and biologicals in mineral fertilizers — a challenge for Mosaic’s proprietary bionutrient technologies. According to Alexandre Alves, head of Mosaic Biosciences in Brazil, the bioinput legislation, approved last year, still lacks implementing regulations, which are essential to bringing the company’s pipeline to market.

“The law is essentially a blank slate. Now we’re working with the Agriculture Ministry to define the rules that would allow the use of these microorganisms,” Alves said. The company expects the regulation to be concluded by year-end.

Among the products awaiting approval is Power Coat, a microbial blend already holding a 25% market share in Canada. It enhances nutrient uptake from soil, fertilizer, and plant roots. Another product, Envirant, aims to extend the shelf life of biologically treated soybean and corn seeds from three months to up to 18 months — a significant leap in durability and logistics.

Both products are undergoing registration in Brazil, with Envirant expected to debut globally in the country.

“Once regulation is in place, we plan to move fast, leveraging our distribution footprint. Within five years, we aim to be a market leader in bionutrition,” said Monteiro.

Brazil’s heavy reliance on imported fertilizers — roughly 85% — creates a compelling case for efficiency gains through biological enhancements, Alves added. “We need to optimize every grain of fertilizer we use.”

Strategic Moves

Mosaic’s push into bionutrition aligns with a broader strategy to streamline its asset portfolio, improve margins, and support more sustainable agricultural practices.

The company is currently seeking partners to explore niobium reserves in Araxa, in Minas Gerais state, and to develop operations at the Taquari-Vassouras complex in Sergipe. Earlier this year, Mosaic sold a decommissioned phosphate mine in Patos de Minas, in Minas Gerais, for $125 million.